cumulative preferred stock meaning

Means the 60000 shares of 4 Cumulative Preferred Stock of the Company par value 100 per share. Of the 1890s and its initial public offering of 5000000 of 8 cumulative preferred stock.

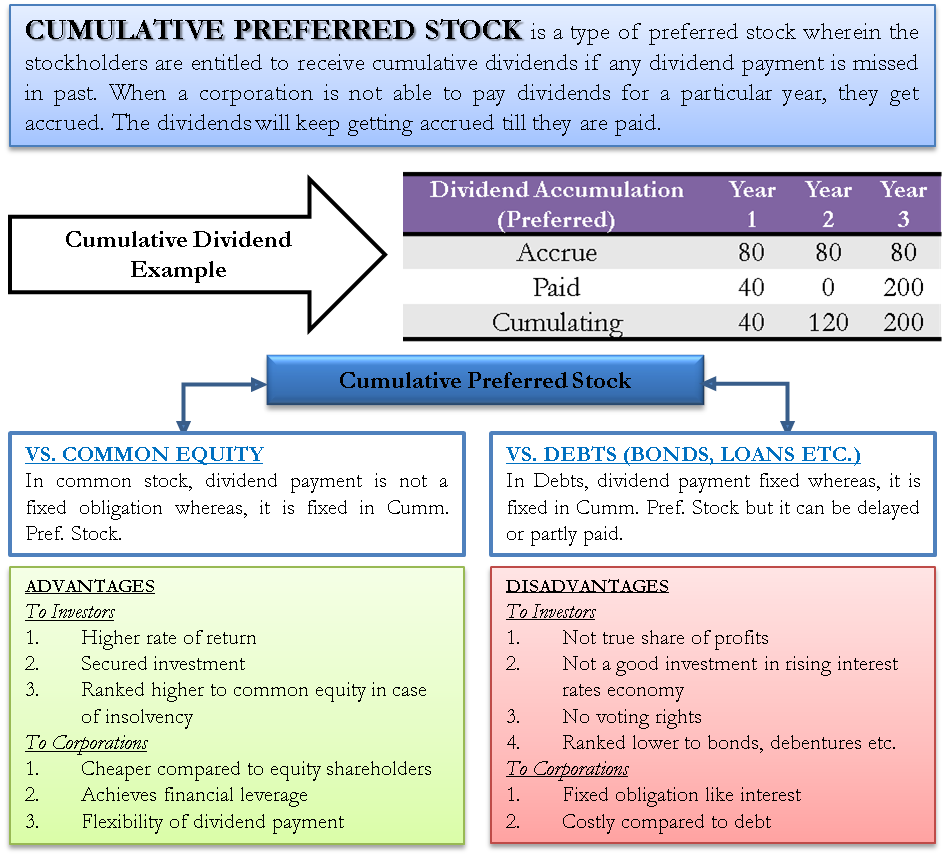

Cumulative Preferred Stock Define Example Benefits Disadvantages

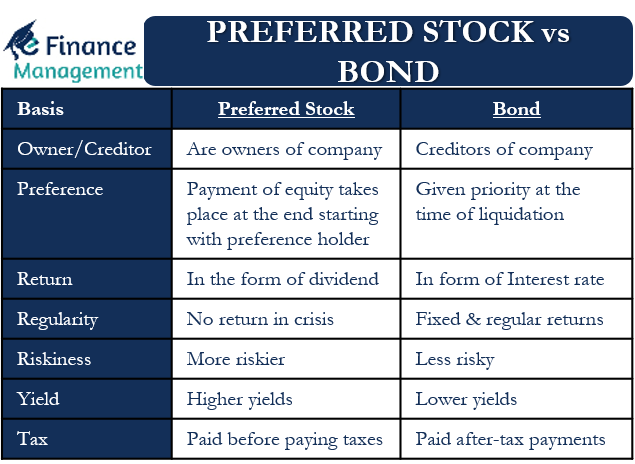

Preferred refers to stock that is paid before common.

. Noncumulative preferred stock allows the issuing company to skip dividends and cancel the companys obligation to eventually pay those dividends. Define 4 Cumulative Preferred Stock. Cumulative preferred stock stock whose dividends if omitted because of insufficient earnings or any other reason accumulate until paid out.

Cumulative preferred stock definition This preferred stock feature assures the owner that any omitted dividends on this stock will be made up before the common stockholders will receive a. The issuers of perpetual preferred stock will always have. Non cumulative stock means its a type of preferred stock that doesnt entitle investors to harvest any missed dividends.

What Is Cumulative Preferred Stock. Perpetual Preferred Stock. Cumulative preferred stock is a class of stock that where undeclared dividends are allowed to accumulate until they are paid.

Cumulative Preferred Stock Preferred stock for which the publicly-traded company must pay all dividends. There are two types of preferred stock. Define ARS Cumulative Preferred Stock.

Cumulative preferred stock is a class of stock that where undeclared dividends are allowed to accumulate until they are paid. Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule and prior to any distributions to the holders of a companys common. They have precedence over common dividends.

Means the 11 38 Cumulative Exchangeable Preferred Stock par value 01 per share of ARS. Mean past due when describing the past omitted dividends on cumulative preferred stock. A company with cumulative preferred stock must pay all outstanding.

If a company misses a dividend payment for any reason it still owes it to cumulative. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. Mandatorily Convertible Preferred Stock means cumulative preferred stock with a no prepayment obligation on the part of the issuer thereof whether at the election of the holders.

Participating preferred stock They are explained in detail below. In other words its a type of preferred stock that has. A perpetual preferred stock is a type of preferred stock that has no maturity date.

In other words its a type of preferred stock that has. Non-cumulative dividends refer to a stock that doesnt pay the investor any dividends that are omitted or unpaid.

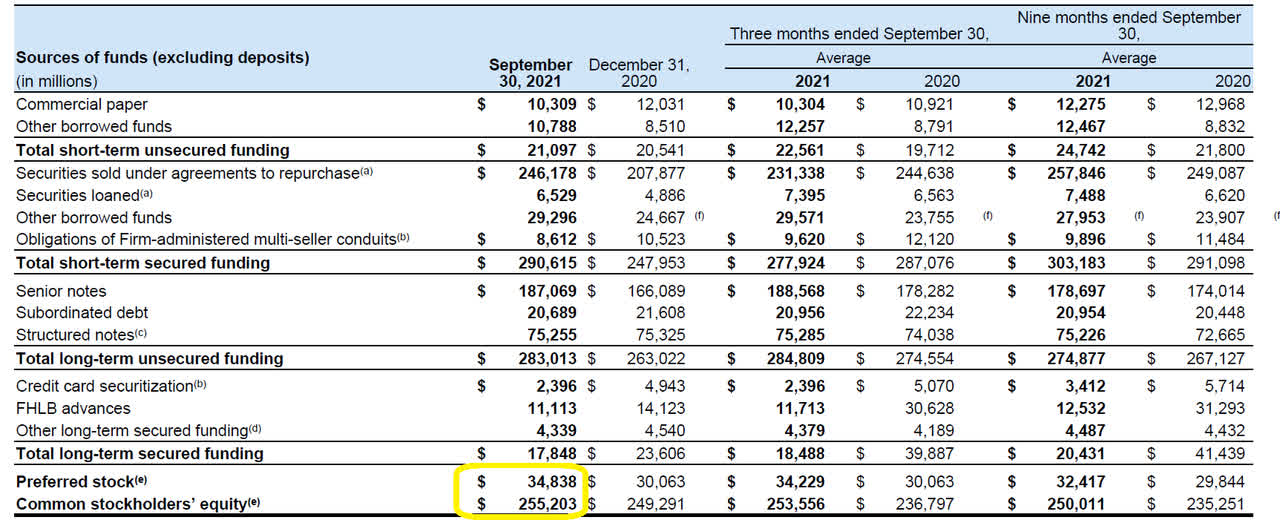

A Closer Look At Jpmorgan S 4 2 Yielding Preferred Shares Nyse Jpm Seeking Alpha

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

13 2 Common And Preferred Stock Principles Of Accounting I Course Hero

What Is Cumulative Preferred Stock Stocks Trading Insights

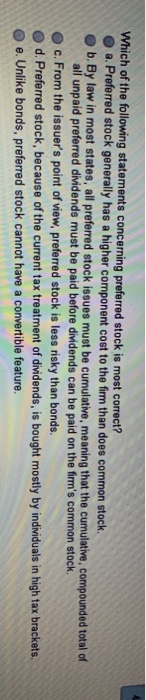

Solved Which Of The Following Statements Concerning Chegg Com

7 3 Classification Of Preferred Stock

What Is Preferred Stock City Of Vancouver Washington Usa

Preference Shares Meaning Features Different Types

A Guide To Investing In Preferred Stocks

What Are Cumulative Preference Shares The Economic Times

Cumulative Preferred Stock Definition How It Works And Example

Preferred Stock Characteristics Archives Business Education

21 Preferred Stock Synonyms Similar Words For Preferred Stock

Preference Shares Meaning Types And Advantages Smart Money By Angel One

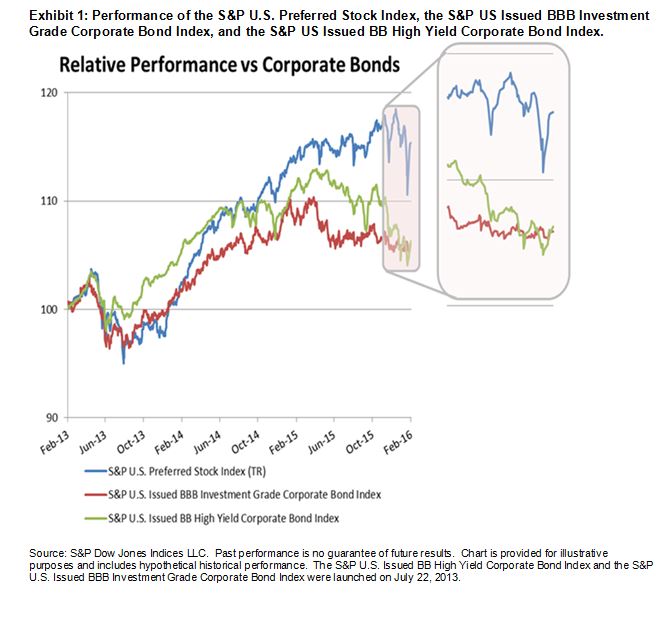

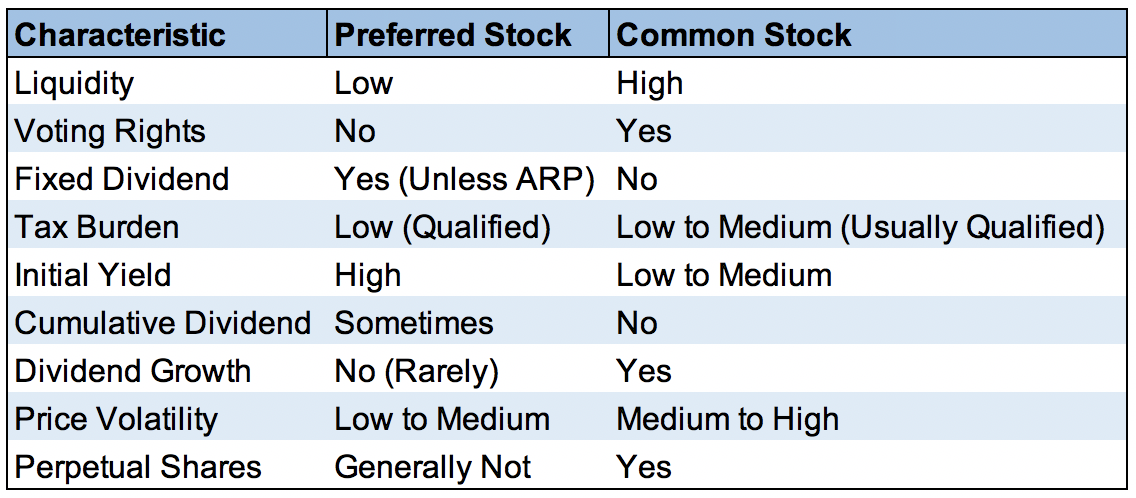

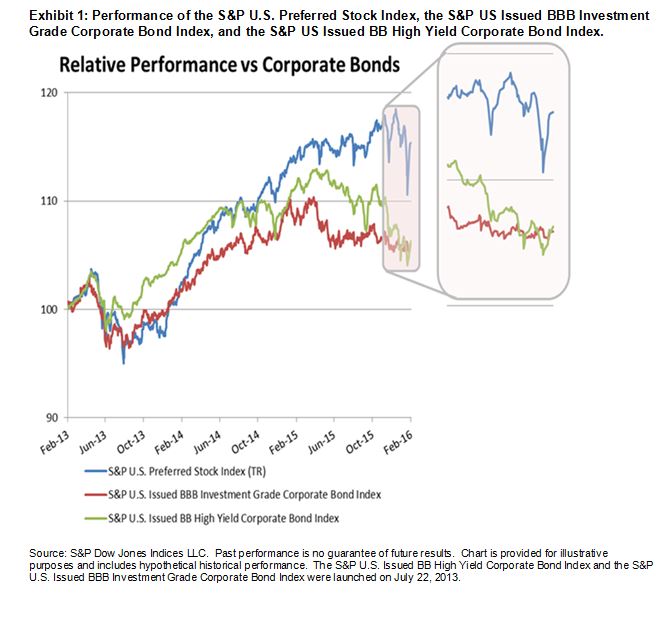

Preferences Of Preferred Stock Indexology Blog S P Dow Jones Indices

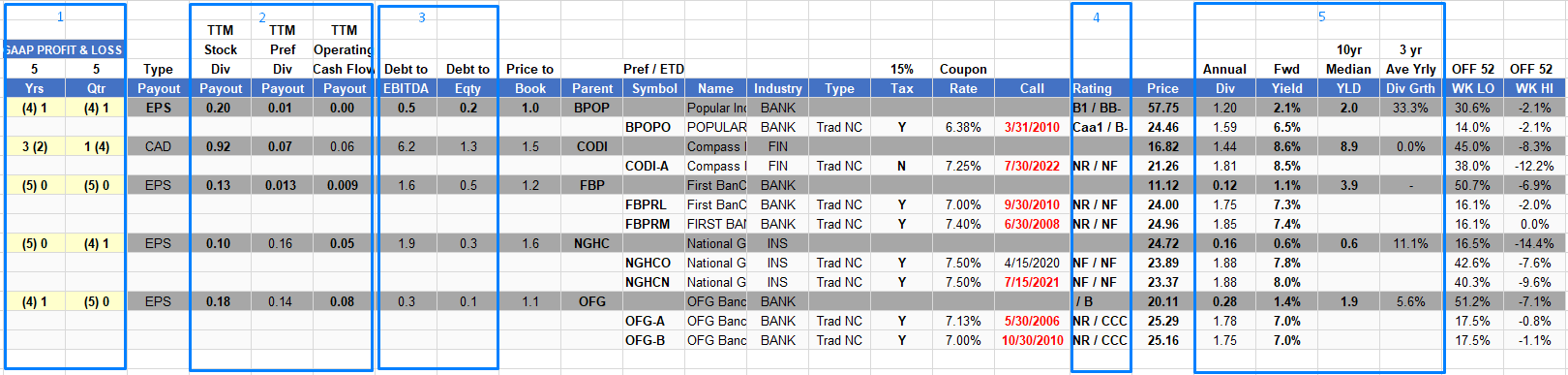

The Top Yields In Non Cumulative Preferred Stocks Seeking Alpha

Preferred Securities Balancing Yield With Risk Charles Schwab